Jeremy Hunt targeted wealthy people and energy companies in a £55 billion ($65 billion) package of tax rises and spending cuts aimed at cleaning up the mess left by unprecedented shocks to the economy.

The measures set out by the Chancellor of the Exchequer will contribute to a 7% drop in the disposable incomes of consumers over the next two years, the biggest squeeze on record, and will wipe out eight years of gains.

Prime Minister Rishi Sunak’s government is seeking to combat inflation and rein in the burgeoning budget deficit to restore credibility with financial markets, which dumped UK assets in September after a disastrous experiment with deep tax cuts by his predecessor, Liz Truss.

Reversing those moves, Hunt will raise the tax burden to the highest since World War II and warned that the economy is in a recession that will shrink output by 1.4% next year.

“We take difficult decisions to tackle inflation and keep mortgage rates down,” Hunt told the House of Commons on Thursday. “But our plan also leads to a shallower downturn, lower energy bills, higher long-term growth and a stronger NHS and education system.”

Hunt’s program represents the sharpest retrenchment in government spending since the austerity budgets set out a decade ago by Conservative Chancellor George Osborne after the global financial crisis.

The scale of the pain along with growing unrest among workers — train drivers, nurses, doctors, and postal staff are among those striking or threatening to do so — adds to the political headaches for the Conservative government after 12 years in office.

While many of the cuts won’t hit until after the deadline for the next election in just over two years, there was little in Hunt’s package to boost the poll ratings of the Tories, currently 20 points behind the Labour opposition.

What Bloomberg Economics Says …

“The key takeaway is that Hunt has decided to delay much of the pain from the fiscal consolidation. That will come beyond the next general election, due by January 2025. Instead, he has chosen to support the economy in the near term. That means fiscal policy will do little to tame underlying inflation over the next two years, putting pressure on the Bank of England to push rates higher.”

–Dan Hanson, Bloomberg Economics. Click for the REACT.

Rachel Reeves, the Labour member of Parliament who shadows Hunt, said the Treasury “picked the pockets” of everyone in the country with an “invoice for the economic carnage” wrought by Truss’s Sept. 23 tax plan.

Interest rates in financial markets have slid since Hunt was named chancellor last month. The yield on the benchmark 10-year UK government bond fell from as much as 4.5% in the wake of Truss’s program to 3.21%, ticking up 7 basis points Thursday.

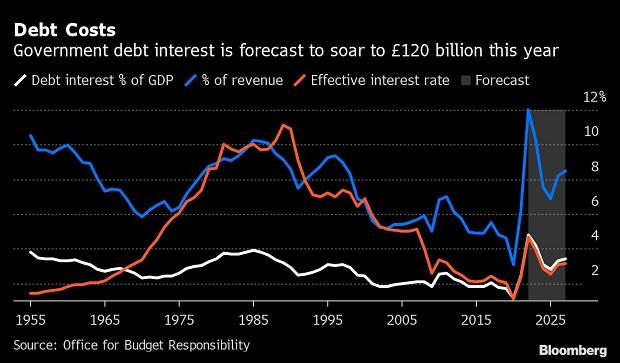

The combination of the recession, double-digit inflation and rising interest rates led to a £75 billion increase in borrowing compared with March expectations in the key 2027-28 forecast year. The Office for Budget Responsibility said “almost two thirds was due to higher debt interest costs.”

To fill the hole, Hunt announced £61.7 billion of savings through a combination of tax rises and spending cuts. The national debt will rise from 84.3% of GDP last year to 97.6% in 2026-27, a 63- year high, before declining slightly.

Hunt extended a windfall tax on oil and gas companies and cut the threshold for paying taxes on dividends and wages over £125,000.

He also raised the minimum wage and targeted support for the most vulnerable people struggling with energy bills and outlined measures to bolster long-term growth.

His task is enormous, patching up the economic damage wrought by the Covid-19 pandemic, the fallout from Russia’s war in Ukraine, and Truss’s disastrous seven-week tenure during which her Chancellor, Kwasi Kwarteng, unveiled a massive program of unfunded tax cuts that sank the pound and roiled the bond markets.

“Surging global energy prices have made the UK a poorer country,” said Paul Johnson, director general of the Institute for Fiscal Studies, adding that Hunt’s address was “a somber affair.”

Measures announced by Hunt in Thursday’s budget:

-

The threshold at which the 45% income tax rate is levied was lowered to £125,140 from £150,000 -

Other income tax thresholds and those for national insurance and inheritance tax were frozen for an extra two years through to April 2028 -

The windfall tax on oil and gas companies was raised to 35% from 25% and a new 45% tax was placed on electricity generators -

The exempt allowance for capital gains tax was more than halved to £6,000 next year and again to £3,000 from April 2024 -

The tax-free allowance for dividend income was halved to £1,000 next year, and again to £500 the following year -

The foreign aid budget remains frozen at 0.5% of GDP until at least April 2028; Sunak had previously pledged to restore it to 0.7% in 2024-25 -

A freeze in the revenue threshold at which businesses must register to pay value-added tax until March 2026 -

Welfare and pensions payments will both increase in line with inflation -

A one-year extension beyond April of the cap on energy bills, but at £3,000 rather than £2,500 -

Cost-of-living payments next year of £900 to households on means-tested benefits, £300 for pensioners and £150 for those on disability benefits -

A go-ahead to build the Sizewell C nuclear power plant -

Electric cars will no longer be exempt from vehicle excise duties from 2025 -

A record 9.7% increase in the national living wage -

The Bank of England’s remit remains the same -

A cut to research and development tax relief for small and medium-sized companies -

Extra spending for schools, social care and the National Health Service -

£6 billion of extra funding for energy efficiency measures from 2025 -

From April, councils will have extra flexibility to raise council tax bills by 3%, with an additional 2% rise permitted to cover social care costs

Hunt — brought in by Truss to replace Kwarteng and steady market nerves, and kept on by Sunak — had already reversed the bulk of that plan before Thursday. While he said Kwarteng had been right to pursue growth, he added that “unfunded tax cuts are as risky as unfunded spending.”

On growth, Hunt said he wanted to spur energy, infrastructure and innovation. The Treasury will work to boost renewable energy and efficiency programs.

It’s also maintaining capital budgets for projects like the HS2 rail upgrade and other transport projects and setting aside more resources for research and development.

“We need to get better at turning world class innovation into world class companies,” Hunt said. “Turn Britain into the world’s next Silicon Valley.”

Hunt also said the government will proceed with a new nuclear plant, Sizewell C, in eastern England and confirmed its commitment to the HS2 high-speed rail project and plans to build more hospitals and roll out super-high-speed broadband.

On energy bills, the Treasury estimates it will spend £43 billion cushioning consumers from soaring electricity and natural gas costs in the fiscal year through April 2023. The following year, that support will be reduced to about £25 billion.

But Hunt also said public spending will grow more slowly than the economy, and departmental budgets will have have real-term spending cuts. He said just over half of the package is made up of spending cuts, with just under half coming from tax rises.

“We want low taxes and sound money,” the Chancellor said. “But sound money has to come first because inflation eats away at the pound in people’s pockets even more insidiously than taxes.”